This includes variables such as tick size, or the minimum price at which trades made be executed. As a result, the real execution price may differ, provided that the clips traded are in significant size.Several factors influence market depth. What Determines Market Depth?While some brokers may be quoting better prices at first glance, the depth of book metric determines how frequently clients can hit the levels that are quoted. In practice market depth depends on the amount of open orders in a given market, which provide liquidity for order execution.

In theory, market depth is the size of an order needed to move the market price by a given amount. This in turn is organized by price level and is reflective of real-time market activity. Broad-based definitions of market depth characterize it as a function of liquidity and trading volume.In its most simplistic sense, market depth reflects a real-time list displaying the quantity to be sold versus unit price. Market Depth is a characteristic of a given market and its ability to handle large order sizes without materially affecting the price of the underlying asset or currency pair.

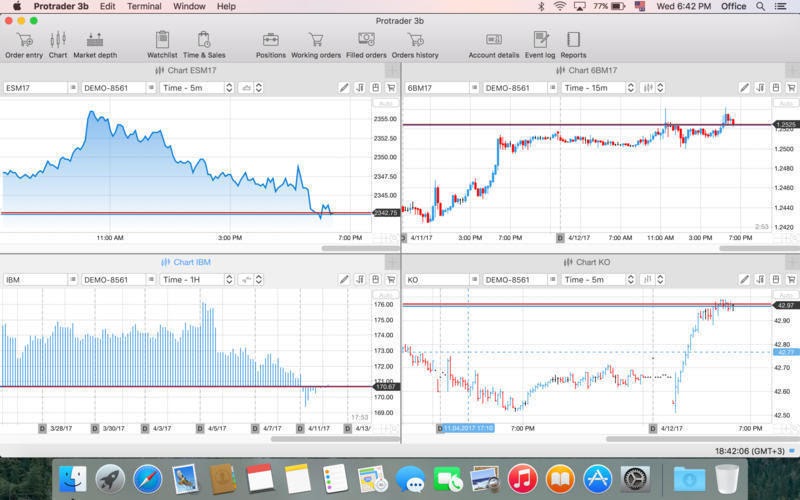

The platform will also be including several functions such as Market Depth

PROTRADER FOR MAC FOR MAC

More specifically, Protrader for Mac users will contain all capabilities that enable trading many asset classes ranging from FX, CFDs, futures, equities, spread betting, ETFs, and more. After a successful beta testing period however, PFSOFT has released a production version of its macOS terminal to the App Store along with possibility of creating demo account that is available to all individuals for testing. Protrader’s expanded functionality into a native macOS version follows on the heels of a recently announced beta version for its front-end platform two months ago. Read this Term, and fundamentals available in a desktop.

PROTRADER FOR MAC MANUAL

Backtesting also serves as an ideal playground for the further development of high-frequency trading as well as evaluating the performance of manual or automated trades. Analytics will continue to have an increasingly significant role in trading as emerging technologies and the advancement of trading applications progress beyond human capability. Backtesting is used by traders to test the consistency and effectiveness of trading strategies and software-based trading solutions against historical price data.

PROTRADER FOR MAC SOFTWARE

This predictive model of analytics generally involves the analysis of historical price patterns that are used in an attempt to determine certain price outcomes. Analytics may also be structured with a descriptive model, where readers attempt to draw a correlation and better understanding as to how and why traders react to a particular set of variables. Traders sometimes implement technical indicators such as moving averages, Bollinger Bands, and breakpoints which are built upon historical data and are used to predict future price movements. How Analytics Relates to Algo TradingAnalytics are relied upon in the concept of algorithmic trading where software is programmed to autonomously signal and/or execute buy and sell orders based upon a series of predetermined factors. In the institutional space, Algo-trading has become vastly competitive over the years as trading institutions seek to outperform competitors through automated systems and the virtual application of trading strategies.The digestion and computation of analytics are also seen in the emerging field of high-frequency trading, where supercomputers are used to analyze multiple markets simultaneously to make near-instantaneous automated trading decisions. Platforms that support HFT have the capability to significantly outperform human traders.This is due to the innate ability to be able to comprehensively analyze big data sets while taking under do consideration an innumerable sum of factors that humans are incapable of comprehending in such speed. Additionally, analytics are seen with backtesting. Analytics also seeks to explain or accurately reflect the relationship between data and effective decision making. In the trading space, analytics are applied in a predictive manner in an attempt to more accurately forecast the price. The new development means that brokers who choose Protrader will be able to connect it to MetaStock's key features which covers news, AnalyticsĪnalytics may be defined as the detection, analysis, and relay of consequential patterns in data.

Understanding Liquidity and Market LiquidityĮarlier this week, the platform developer made news after it expanded its pool of analytical tools for its PTMC solutions suite.

New Operational Resilience Regulations Loom amid Financial Sector’s Ongoing Outage Problem.

0 kommentar(er)

0 kommentar(er)